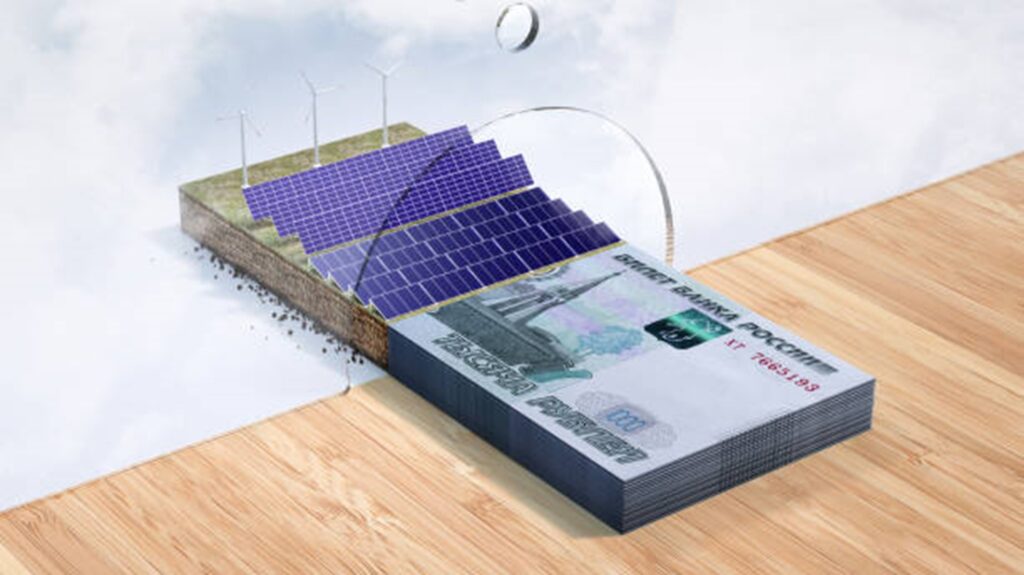

Looking to save money while reducing your carbon footprint? The federal tax credit for solar panels is here to help. This incentive offers a significant advantage to homeowners and businesses looking to invest in renewable energy. By installing solar panels, you not only generate clean electricity but also become eligible for a tax credit that can offset a portion of the installation costs.

Below, we cover all of the details of the tax credit for solar panels and demonstrate how Solar by Peak to Peak‘s solar solutions can help you harness the power of the sun while maximizing your savings potential.

Benefits of Going Solar: Environmental and Financial

Environmental Benefits of Going Solar

The impact is significant. By installing solar panels, you can actively contribute to reducing greenhouse gas emissions. Traditional energy sources, such as coal and natural gas, release harmful gases into the atmosphere when they are burned for electricity. These emissions are one of the leading causes of climate change.

Solar energy, on the other hand, is a clean and renewable energy source that produces electricity without any harmful emissions. By harnessing the power of the sun, solar panels generate electricity in an environmentally friendly manner. This means that when you switch to solar power, you are directly reducing your carbon footprint and helping combat climate change.

Financial Advantages of Going Solar

In addition to its positive environmental impact, going solar also offers potential financial advantages. One notable benefit is long-term savings on your energy bills. When you generate your own electricity through solar panels, you rely less on traditional utility companies for power supplies. As a result, your monthly electricity bills can significantly decrease or even be eliminated entirely.

Solar panels have a lifespan of around 25–30 years with minimal maintenance requirements. This means that once installed, they will continue generating free electricity for decades to come. Over time, these savings can add up substantially and provide a return on investment.

Furthermore, installing solar panels can increase the value of your home. Many prospective buyers are increasingly interested in eco-friendly homes with sustainable features like solar panels. Studies have shown that homes equipped with solar systems tend to sell faster and at higher prices compared to properties without them.

Additional Benefits

Aside from environmental and financial advantages, there are several other benefits associated with going solar:

Energy Independence

By producing your own electricity through solar power, you become less reliant on external energy sources. This grants you greater control over your energy consumption and reduces your vulnerability to fluctuations in energy prices.

Supporting a Sustainable Future

Choosing solar energy supports the growth of renewable energy sources and contributes to a more sustainable future for generations to come. It demonstrates your commitment to reducing reliance on fossil fuels and embracing clean, green energy alternatives.

Energy Efficiency

Solar panels are highly efficient at converting sunlight into electricity. With advancements in technology, solar panels have become even more efficient over time, ensuring maximum utilization of available sunlight.

Government Incentives

Many governments offer tax credits and incentives for installing solar panels. These financial incentives can help offset the initial installation costs, making solar power more affordable and accessible for homeowners.

Job Creation

The transition to renewable energy sources like solar power creates new job opportunities in the clean energy sector. By going solar, you contribute to job creation and support local economies.

Federal Solar Tax Credit: Overview and Eligibility

Understanding the Federal Tax Credit for Solar Panels

The federal tax credit for solar panels is an incentive program designed to encourage residential solar installations. It allows homeowners to claim a tax credit based on a percentage of their solar system’s cost. This credit can significantly reduce the overall cost of going solar and make it more affordable for individuals.

To have a clear understanding of how this tax credit works, it’s essential to know its potential financial impact on your investment. By claiming the federal tax credit, you can potentially receive a substantial reduction in your federal income taxes. The amount of the credit is calculated as a percentage of your qualified expenses, such as the cost of purchasing and installing solar panels.

However, it’s crucial to note that there are eligibility requirements and limitations associated with claiming this credit. To be eligible, you must own or lease a residential property with solar panels installed between specific dates outlined by the Internal Revenue Service (IRS). Only systems that meet certain performance and safety standards qualify for the tax credit.

The federal tax credit for solar panels is considered one of the most significant incentives for residential solar installations. It provides homeowners with an opportunity to save money while transitioning to clean energy sources. By reducing dependence on traditional fossil fuels, individuals can contribute towards environmental preservation and combat climate change.

Eligibility Criteria for Individuals to Claim the ITC

To determine if you meet the eligibility criteria to claim the Investment Tax Credit (ITC), you need to understand who qualifies as an individual taxpayer under this program. Individual taxpayers include homeowners who install solar systems on their primary residences or second homes.

Income restrictions may also affect your ability to claim the ITC. Currently, there are no income limits or phase-out thresholds associated with this tax credit. However, it’s important to consult with a tax professional or refer directly to IRS guidelines regarding any changes in income restrictions that may occur in the future.

Whether you own or lease a residential property, it can impact your eligibility for the federal tax credit. If you own the property, you are typically eligible to claim the credit. However, if you lease a property and do not have ownership rights, it is generally the property owner who can claim the tax credit.

Interaction between Federal Energy Tax Credits

When installing solar panels, it’s essential to understand how different federal energy tax credits interact with each other. While claiming multiple incentives may seem appealing, there may be limitations or restrictions to consider.

The federal tax credit for solar panels cannot be combined with other incentives that provide a direct monetary benefit for the same installation costs. For example, if you receive a cash rebate from your utility company for installing solar panels, this amount would need to be deducted from your qualified expenses when calculating the federal tax credit.

However, it’s worth noting that other renewable energy systems may be eligible for additional tax incentives. These include wind turbines, geothermal heat pumps, and fuel cells. Each of these technologies has its own specific requirements and potential financial benefits that individuals should explore further.

Understanding how various energy-related credits interact can help homeowners make informed decisions about their investment in renewable energy systems. It’s advisable to consult with a tax professional or refer directly to IRS guidelines to ensure compliance and maximize available incentives.

How to Claim the Federal Solar Tax Credit

Filing Requirements for the Solar Tax Credit

To successfully claim the solar tax credit, it’s essential to familiarize yourself with the necessary filing requirements. This will ensure that you complete the process correctly and maximize your potential savings. Here are some key points to consider:

Forms and Documentation

Make sure you understand which forms and documentation are needed when submitting your claim to the IRS. Typically, you’ll need to complete Form 5695, “Residential Energy Credits,” along with your regular tax return. Be prepared to provide documentation, such as receipts or invoices, for your solar panel installation expenses.

Deadlines

It’s crucial to be aware of the important deadlines associated with filing for the solar tax credit. Generally, you must have installed your solar panels before December 31st of the tax year in which you’re claiming the credit. Ensure that you submit your claim accurately and on time to avoid missing out on this valuable opportunity.

Smooth Process Tips

To ensure a smooth process when applying for and receiving your solar panel tax credits, consider these tips:

Keep Meticulous Records

Maintain organized records of all relevant documents, including receipts, invoices, and any other supporting evidence.

Seek Professional Guidance if Needed

If navigating through taxes feels overwhelming or confusing, don’t hesitate to consult a tax professional who specializes in renewable energy credits.

Double-Check Calculations

Take extra care when calculating the amount of credit you’re eligible for. Errors could result in an inaccurate claim or missed savings.

Multiple Claims of the Solar Tax Credit

If you have multiple properties or installations equipped with solar panels, you might wonder if it’s possible to make multiple claims for the solar tax credit. While there are limitations and restrictions on claiming this credit more than once, there are scenarios where it may be possible:

Multiple Properties

If you own more than one property with solar panels, you can potentially claim the solar tax credit for each qualifying installation. However, keep in mind that there are separate limitations and maximum credit amounts for each property.

Multiple Installations

If you have multiple installations on a single property, such as adding additional solar panels to an existing system, you may be eligible to claim the credit again. However, certain conditions must be met, such as not exceeding the maximum credit limit.

Navigating the process of making multiple claims without running afoul of IRS regulations can be complex. It’s crucial to consult with a tax professional who can guide you through the specific requirements and ensure compliance.

Utilizing the Federal Tax Credit Without Owning Taxes

Even if you don’t owe taxes or have little tax liability, there are still options for utilizing the federal tax credit for solar panels. Here are some alternatives to consider:

Refundable Credits

The tax credit for solar panels is a non-refundable credit, meaning it can only reduce your tax liability to zero. However, there are refundable credits available that can benefit individuals with little or no tax liability. For example, if you qualify for other refundable credits like the Earned Income Tax Credit (EITC), any unused portion of your tax credit could potentially increase your refund amount.

Carrying Forward Unused Credits

If you’re unable to utilize the full amount of your solar tax credit in a given year due to limited tax liability, don’t worry! Unused credits can be carried forward to future years until they are fully utilized. This allows you to take advantage of the savings when your financial circumstances change or when your tax liability increases.

Remember that navigating through these alternative ways of utilizing the solar tax credit may require careful consideration and professional advice. Each individual’s situation is unique, so it’s crucial to assess your specific circumstances and explore all available options.

State Solar Incentives and Rebates

State-Level Tax Credits for Solar Energy Systems

If you’re considering installing solar panels on your home, it’s essential to explore the state-level tax credits available in your area. Many states offer financial incentives to promote the adoption of renewable energy sources like solar power. These tax credits can significantly reduce the overall cost of installing a solar energy system.

Research About the Specific State-Level Tax Credits Offered in Your Region

One of the first steps is to find out about the specific state-level tax credits offered in your region. Each state has its own set of incentives, so it’s crucial to research what is available where you live. By taking advantage of these programs, you can save a substantial amount of money on your solar panel installation.

Additional Financial Incentives to Encourage Homeowners to Go Solar

In addition to tax credits, many states provide additional financial incentives to encourage homeowners to go solar. These may include rebates, grants, or performance-based incentives. These extra benefits can further offset the initial investment and make adopting solar power more affordable for homeowners.

Some States May Require Specific Certifications or Qualifications for Both Installers and Equipment

It’s important to note that each state may have different eligibility criteria and requirements for its solar tax credit programs. Some states may require specific certifications or qualifications for both installers and the equipment used in the system. It’s crucial to familiarize yourself with these guidelines before proceeding with your installation.

Consider Combining Federal and State Incentives

To maximize your savings when going solar, consider combining federal and state incentives. The federal government offers a generous Residential Renewable Energy Tax Credit (commonly known as the Federal Solar Tax Credit). By taking advantage of both federal and state-level incentives, you can significantly reduce the cost of installing a solar energy system on your property.

Additionally, some states may offer tax exemptions for solar installations, providing further financial relief for eligible homeowners.

Residential Clean Energy Credit for Qualified Homes

If you’re considering installing solar panels on your home, you may be eligible for a residential clean energy credit. This credit is designed to incentivize homeowners to invest in clean energy systems and reduce their carbon footprint. Let’s dive into the details of this tax credit and understand how it can benefit qualified homes.

Eligibility Criteria and Requirements

To qualify for the residential clean energy credit, your home must meet certain criteria. First and foremost, it should serve as your principal residence. This means that vacation homes or rental properties are not eligible for the credit. The clean energy system installed must be considered “qualified property” under the IRS guidelines.

The IRS defines qualified property as any equipment that uses solar energy to generate electricity or heat water for use in a dwelling unit located in the United States. It’s important to note that this credit is specifically for residential properties and does not extend to commercial buildings.

How It Differs from the Federal Tax Credit for Solar Panels

While both the residential clean energy credit and the federal tax credit for solar panels aim to promote renewable energy adoption, they have some key differences. The federal tax credit applies to both residential and commercial installations, while the residential clean energy credit is solely focused on qualified homes.

Another distinction lies in the percentage of expenses covered by each credit. The federal tax credit typically covers 26% of eligible expenses, whereas the residential clean energy credit may cover up to 30%. However, it’s essential to consult with a tax professional or refer directly to IRS guidelines for accurate information regarding specific percentages and limits.

Other Clean Energy Systems That May Qualify

Although we’ve been discussing solar panels thus far, it’s worth noting that there are other types of clean energy systems that may also qualify for the residential clean energy credit. These include:

Wind Turbines

If you live in an area with sufficient wind resources, installing a wind turbine to generate electricity can potentially qualify for the credit.

Geothermal Heat Pumps

These systems use the constant temperature of the earth to heat and cool homes efficiently. If you have a geothermal heat pump installed, you may be eligible for the residential clean energy credit. Additionally, solar water heaters were generally eligible for a federal tax credit known as the Residential Renewable Energy Tax Credit.

Fuel Cells

While not as common as solar panels or wind turbines, fuel cells that convert fuel into electricity using an electrochemical process can also qualify for the credit.

It’s important to research and understand the specific requirements and qualifications for each type of clean energy system before making any decisions.

Unlock Savings and Sustainability: Maximize Your Tax Credit Potential with Solar by Peak to Peak

Solar by Peak to Peak’s Cutting-Edge Solar Solutions

At Solar by Peak to Peak, we pride ourselves on offering cutting-edge solar solutions that not only help you save money but also contribute to a more sustainable future. Our team of experts is dedicated to providing top-notch solar panel installations that maximize your tax credit potential while reducing your carbon footprint.

We understand that quality and reliability are paramount. That’s why we partner with trusted manufacturers who meet our rigorous standards. Our solar panels are designed to withstand the test of time and perform optimally in various weather conditions, ensuring long-term savings for you.

Our Commitment to Quality and Reliability

At Solar by Peak to Peak, we understand that investing in solar panels is a big decision. That’s why we prioritize quality and reliability in everything we do. We work closely with our customers to assess their specific needs and design customized solar solutions that meet their energy goals.

When you choose Solar by Peak to Peak, you can expect:

Expert Consultation

Our team of experts will guide you through the entire process, from initial consultation to installation and beyond. We take the time to understand your energy needs and provide tailored recommendations that maximize your savings potential.

Professional Installation

Our certified technicians handle every aspect of the installation process with precision and care. We ensure that your solar panels are installed correctly and efficiently, guaranteeing optimal performance for years to come.

Ongoing Support

We believe in building long-term relationships with our customers. That’s why we offer comprehensive support even after the installation is complete. Whether you have questions about maintenance or need assistance with monitoring your system’s performance, our dedicated team is here to help.

Get Started on Your Solar Journey with Us!

Ready to unlock savings and sustainability with solar power? Get started on your solar journey with Solar by Peak to Peak today! Here’s how:

- Free Consultation: Contact us for a free consultation, where we’ll assess your energy needs and provide personalized recommendations based on your home’s unique characteristics.

- Customized Proposal: After evaluating your requirements, we’ll create a customized proposal outlining the cost, savings potential, and estimated return on investment for installing solar panels.

- Professional Installation: Once you approve the proposal, our team will schedule a convenient time for installation. Sit back and relax as our experts handle all aspects of the process, ensuring a seamless experience from start to finish.

- Enjoy Savings and Sustainability: With your new solar panels in place, start enjoying immediate savings on your energy bills while reducing your carbon footprint. Plus, take advantage of lucrative tax credits that put more money back into your pocket.

At Solar by Peak to Peak, we’re passionate about helping homeowners like you harness the power of solar energy while maximizing tax credit potential. Join us in creating a sustainable future, and start saving today!

How to Get a Tax Credit for Solar Panels

Don’t wait any longer to start enjoying the benefits of solar power and saving on your energy bills.

Contact Solar by Peak to Peak today and let us guide you through the process of installing solar panels on your home. Our team of experts will help you navigate the paperwork, ensure you meet all eligibility requirements, and make sure you get every dollar of tax credit you deserve.

Remember, going solar is an investment that pays off in more ways than one. Not only will you reduce your carbon footprint and save money on electricity bills, but you’ll also contribute to a healthier environment for future generations. So why wait? Take control of your energy future by harnessing the power of the sun with Solar by Peak’s solar solutions.